Financing and Accounting Strategies for Food Startup Success

/On September 16th 2021, we welcomed Crystal Estrada, VP & Head of US Accounting and David Davick, CFO at Propeller Industries, to reveal some of the most successful financing and accounting strategies for food startups success. During the session, Crystal and David reviewed the phases of growth of a food startup, describing the financial requirements at each phase. They also discussed the financial metrics that investors look for and went over the financial statements that founders need to articulate a thorough financial story and successfully raise funds. Read on for an overview of the main points and download the presentation slides.

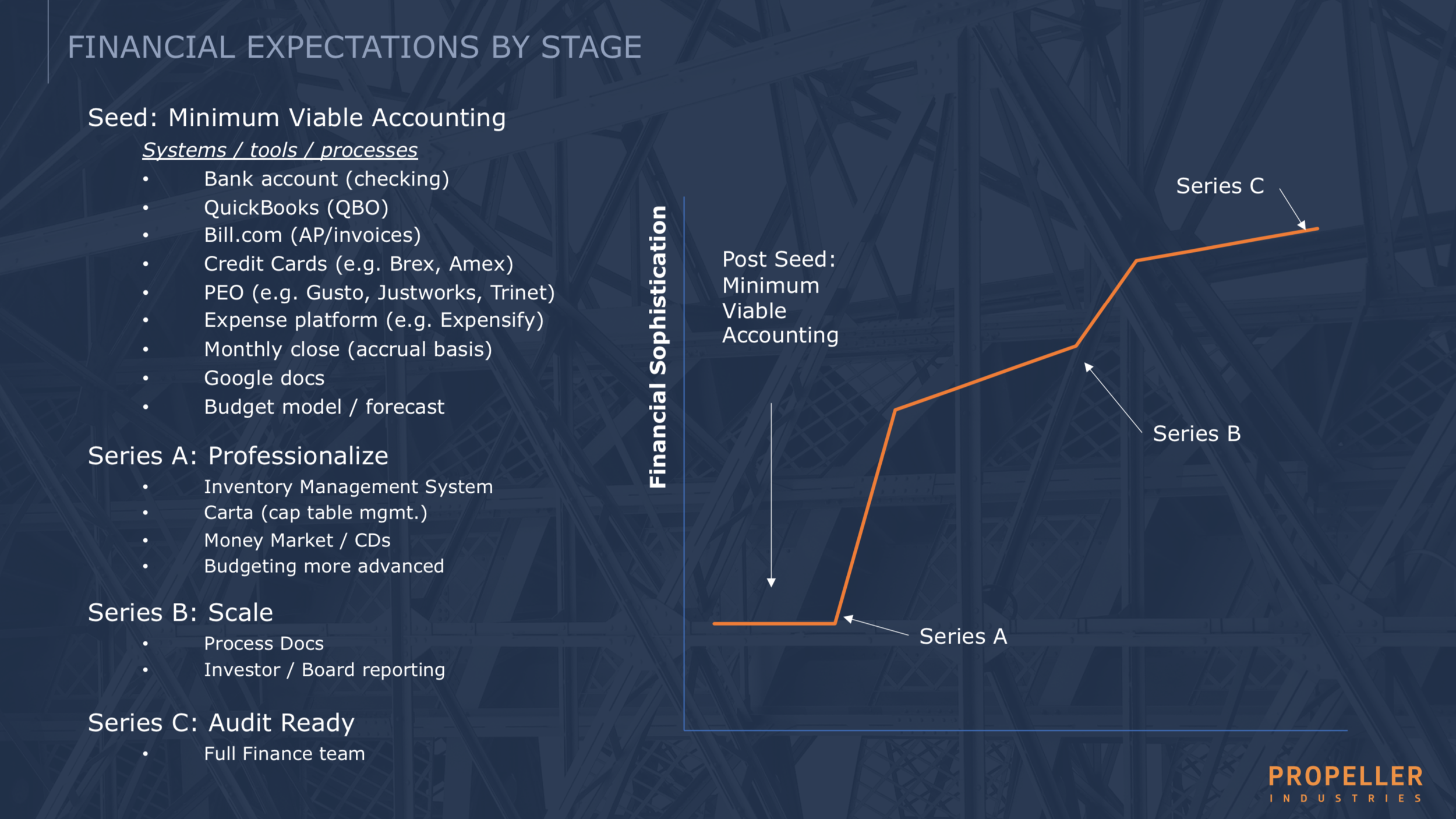

Financial expectations through the growth cycle

As you expand your market reach and develop your company (and team), your financial requirements and expectations evolve.

Keeping your business and finances organized right from the start enables you to focus on growing your business seamlessly. In an early-stage startup, leveraging tools that are time-saving and simple to use is key to helping your business thrive.

Crystal and David suggest:

SOS Inventory: cost-effective inventory management system that captures the cost of goods sold

When considering startups for investment, investors typically look for revenue drivers and growth rate, gross margin and profitability, as well as a solid cash flow. If you’re an early-stage founder, aim for a gross margin of 30% or higher. No matter the stage you’re at, understand your burn rate, i.e. how much cash you’re using and why, as well as your runway, i.e. how much cash is left and why.

Investors are particularly interested in knowing if:

Your demand is growing

Your sales are increasing over time

Your gross margin is consistent and increasing over time

You are on the path towards exceeding category averages

Your customer base -- or velocity -- is growing

These metrics are essential for them to understand your business model and market potential. Think of them as story points to focus on when articulating your financial story. The best way to track and highlight these metrics is to prepare the following financial statements:

Income statement (or P&L): reflects your revenues, cost of sales and operating expenses, and overall profit or loss of income over a period of time.

Balance sheet: reflects your equity, i.e. the cash that you own (assets) less the cash that you owe (liabilities), at a specific moment in time. The balance sheet helps you predict how your business will be affected by external factors and maintain a healthy gross margin.

Cash flow statement: reflects the flow of cash in and out of your business, i.e. how and how much you used and generated cash, over a period of time. Keep in mind that you will need your income statement and balance sheet to issue a cash flow statement.

Investors seek positive results. They are most interested in a successful product that is faring well in comparison to other products. As you formulate your story, try to answer the following questions:

What am I spending money on?

Am I spending appropriately for this stage?

How can I optimize my business?

Your role as a founder is to communicate your story and progress, all while visualizing your path to profitability. Be sure to develop a strong understanding of your financials and draw the key metrics that you need to articulate a compelling story and confidently showcase your value proposition and path to success. Being thorough and optimistic is a powerful strategy for fundraising as well as nurturing successful investor relations.

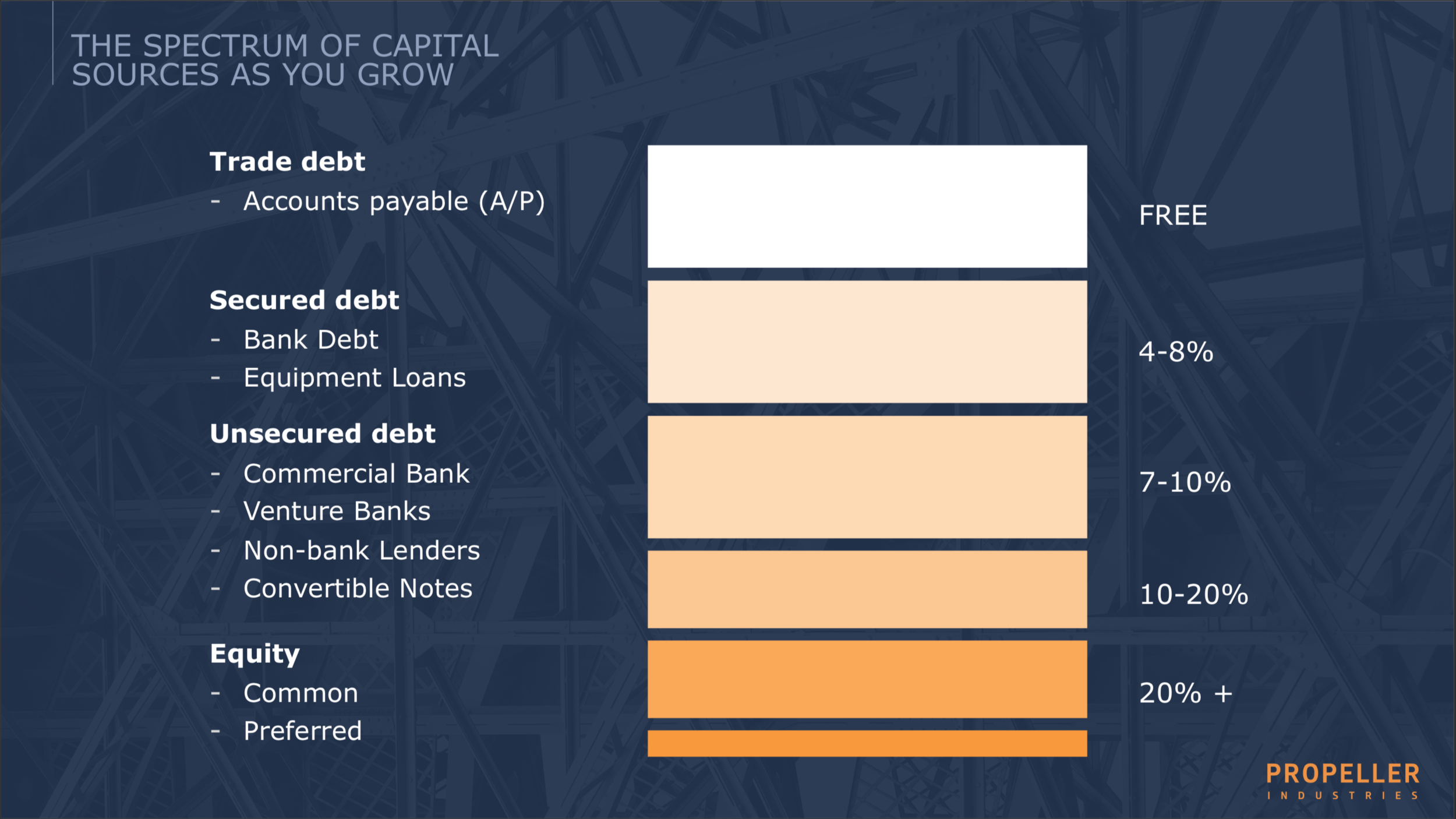

Sources of capital

Food founders can leverage a spectrum of capital sources as their business grows.

When it comes to funding Crystal and David recommend you consider:

Convertible notes, or debt convertible to equity upon future event, which are increasingly popular for < $1M seed financing

Preferred stock, which is typical for VC funding and offers greater protection

Crowdfunding, which broadens ownership and democratizes access but can cost you fees of ~5% to ~8% of the raise amount needed

Alternative lenders such as merchant cash advance or revenue financing, often with a payback as a % of e-commerce sales.

To learn more about the sources of capital at different stages, please refer to slides 19-25 in the presentation slides.

If you are looking for financing and accounting support or have any questions, you can follow up with David Davick and Crystal Estrada!

About the Speakers

Crystal Estrada is VP & Head of US Accounting at Propeller, bringing over two decades of experience in accounting and business operations to the firm. Prior to joining Propeller, Crystal served in a diverse set of roles within non-profit organizations, public accounting, as well as startup companies in the oil & gas, restaurant, and construction industries.

Since joining Propeller in 2016, David Davick has served as CFO for numerous SaaS, CPG, and Tech clients, giving him a wide-angle view of the company’s early-stage client base. In addition to his client work, Dave brings this perspective to several critical responsibilities for Propeller’s West Coast operations including leading the company’s Business Development efforts and helping to formalize the company’s Transaction Advisory practice.

About propeller industries

Propeller Industries is the leading strategic financial advisory firm empowering ambitious companies with confidence, clarity, and community to build their greatest financial vitality. They partner with venture-stage companies to bring them the financial solutions and muscle to grow efficiently. Their clients are armed with a financial team with all the right skills at all the right times to know their business better, helping them to see around corners and sleep better at night.